Yearly pay calculator with overtime

1500 per hour x 40 600 x 52 31200 a year. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

4 Ways To Calculate Annual Salary Wikihow

If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime.

. For the cashier in our example at the hourly wage. Hourly Wage Tax Calculator 202223. See where that hard-earned money goes - Federal Income Tax Social Security and.

For example imagine you earn 5000 per month. 365 days in the year please use 366 for leap years Formula. C B PAPR.

To calculate your yearly salary from monthly simply multiply your monthly payment by 12. 57 rows Here are the steps to calculate annual income based on an hourly wage using a 17 hourly wage working 8 hours per day 5 days a week every week as an example. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Taxes Paid Filed - 100 Guarantee. Unless exempt employees covered by the Act must receive overtime pay for hours worked over 40 in a workweek at a rate not less than time and one-half their regular rates of pay. To decide your hourly salary divide your annual income with 2080.

Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be. The algorithm behind this overtime calculator is based on these formulas. In fact 848 municipalities have their own income taxes.

Annual Salary Bi-Weekly Gross 14 days. Work out your overtime with our Overtime Calculator. 7500 12 90000 Total Pay per Year.

B A OVWK. Due to the nature of hourly wages the amount paid is variable. 14 days in a bi-weekly pay period.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. A RHPR OVTM. You can claim overtime if you are.

Many cities and villages in Ohio levy their own municipal income taxes. Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also withholds taxes from your pay. Financial advisors can also help with investing and financial planning -.

Calculating Annual Salary Using Bi-Weekly Gross. 2084 x 10 overtime hours 20840 total overtime wages Step 5. A financial advisor in Pennsylvania can help you understand how taxes fit into your overall financial goals.

Assuming you make a hundred thousand dollars in 12 months your hourly wage is 100000 2080 or 4807. This shows you the total pay you are due of regular time and overtime. To calculate your yearly salary it.

Multiply the overtime hourly rate by the number of extra hours the employee worked. Overtime pay per period. See where that hard-earned money goes -.

Overtime pay per year. Overtime Pay per Year. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Hourly To Salary What Is My Annual Income

3 Ways To Calculate Your Hourly Rate Wikihow

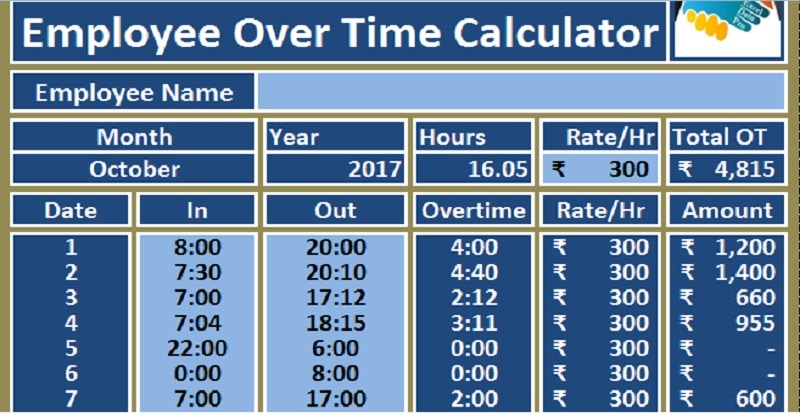

Download Employee Overtime Calculator Excel Template Exceldatapro

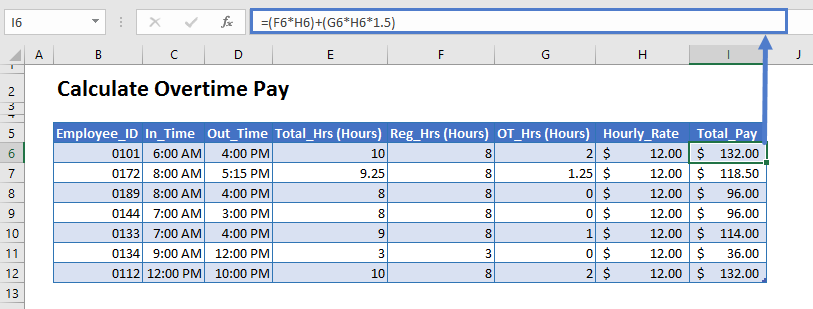

Excel Formula To Calculate Hours Worked Overtime With Template

Overtime Calculator

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

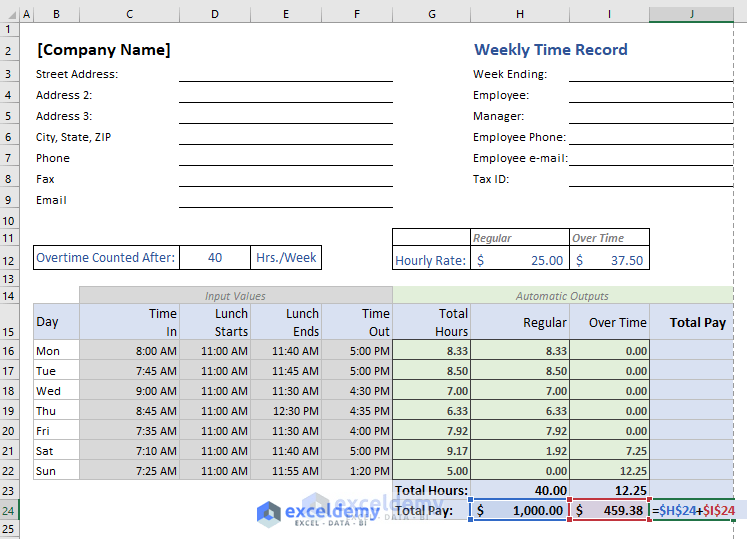

Calculate Overtime In Excel Google Sheets Automate Excel

Excel Formula Basic Overtime Calculation Formula

How To Calculate Wages 14 Steps With Pictures Wikihow

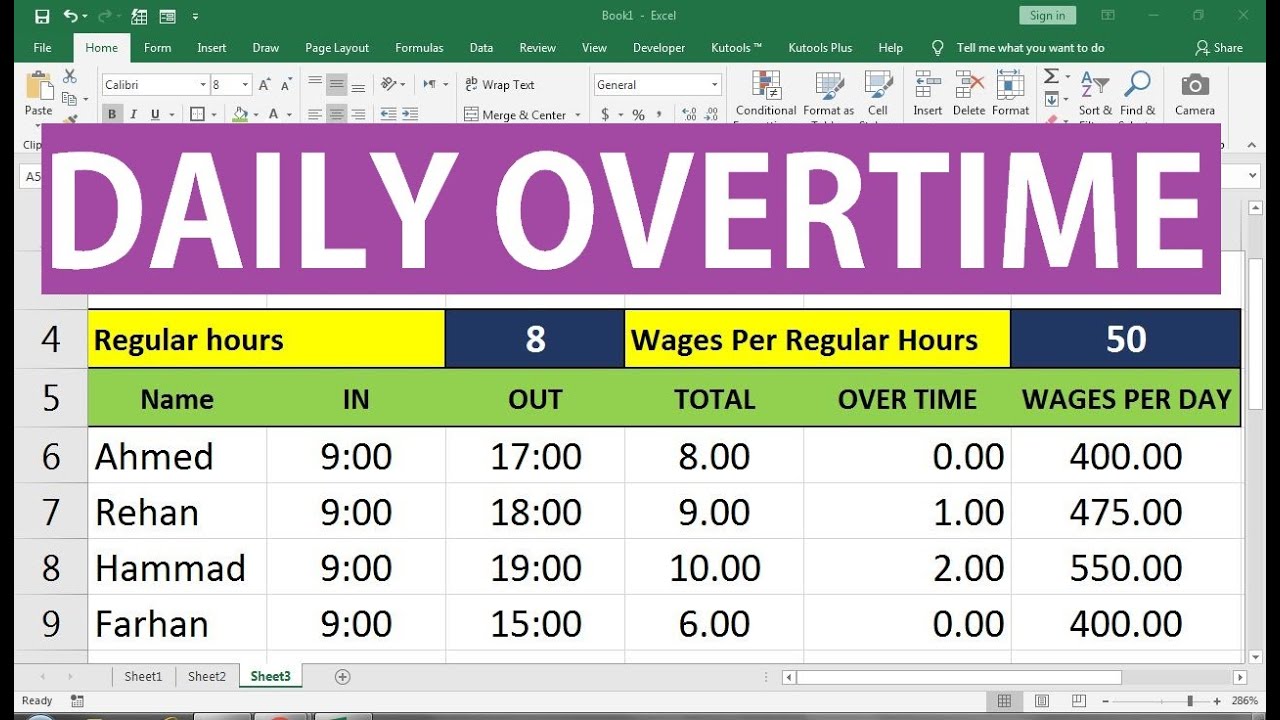

Overtime Calculation Formula In Excel Youtube

Download Employee Overtime Calculator Excel Template Exceldatapro

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

How To Calculate Overtime Pay From For Salary Employees Youtube

Calculate Overtime In Excel Google Sheets Automate Excel

How To Calculate Wages 14 Steps With Pictures Wikihow

Excel Formula Timesheet Overtime Calculation Formula Exceljet

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide